🔄 Last updated article: 11 March 2024

🥈 It is the #2 investment platform choice for MoneyMinority

🎁 Open an account and get €100 off commissions →

❗ See what you can do about the PRIIPs problem for small EU countries →

DEGIRO is a European brokerage that manages €51.7 billion in client assets for over 2.5 million investors. It was established in the Netherlands in 2008.

The platform’s low fees, high security, and simplicity make it an attractive option for:

- Investors who pursue strategies with long-term time frames

- Traders who are looking for a platform to execute simple trades

If you want to know more about the products, fees, positives, negatives, and the big problem with DEGIRO, then keep reading. Below is one of the most detailed guides to the platform.

For a limited period, first transaction fees up to €100 are covered by DEGIRO

Why choose DEGIRO (and why not):

My opinion of DEGIRO – in a nutshell

As a strong advocate of risk diversification in investing, I even apply it at the platform level. The two main platforms I choose for my investments are:

- Saxo bank

- DEGIRO

🛡️ Security: DEGIRO started its operation in 2008 and was acquired by German Flatex Bank in 2020. The Dutch part is monitored by the country’s central bank (DNB 🇳🇱) and regulated by the local capital market commission (AFM 🇳🇱). Other European clients (such as Greeks) fall under the German branch that is regulated by the German Capital Market Commission (BaFin 🇩🇪).

Is DEGIRO a scam? No, DEGIRO is not a scam. Cash deposits are protected (up to €100,000) by Germany’s deposit guarantee scheme (EdB), while invested funds are protected (up to €20,000) by the EU’s Investment Compensation Scheme (ICS).

🔍 Read more: DEGIRO’s security, guarantees and regulation →

💸 Commissions and fees: DEGIRO offers some of the lowest commissions in the market. There is no extra charge for account creation, deposits or withdrawals. Also, there are no portfolio management or inactivity fees. Trading fees are pretty low as well. Trading US stocks start from €2 per order, Greek stocks from €1.5 and global ETFs from €1. Finally, there is no minimum deposit limit.

🔍 Read more: DEGIRO commissions and fees →

📊 Available products: You get access to 29 stock exchanges (including ATHEX), so you can buy and sell stocks, ETFs, and government or corporate bonds.

What’s going on with PRIIPs, KIDs and ETFs ban: Unfortunately, the PRIIPs legislation has very much limited the ETFs available to local investors in many small European countries such as Greece, Chezh Republic and Slovenia. Fortunately, there is a way around the ban →

🔍 Read more: DEGIRO’s investment products →

💻 Create a new account: You will need an identification document (ID or passport), a residential address document in English, your mobile phone and an internet connection.

🔍 Read more: How to create a DEGIRO account →

📈 How to buy ETFs and stocks: You search for the investment product of your choice in the search bar (by name, ticker symbol or ISIN) and click “Trade”. Then you enter the appropriate order (market or limit) with the quantity you want to buy, and… it’s yours!

🔍 Read more: How to buy and sell products at DEGIRO →

👎 My review: I didn’t like the absence of interest on cash that remains uninvested in your account along with the mandatory securities lending for which, in fact, you get no reward.

Is DEGIRO the right broker for you?

If you are a long-term investor (i.e. you buy, hold and sell after years – or don’t sell at all) and looking for a platform to execute your orders, then DEGIRO may be your platform.

Its low commissions, simple and easy-to-use platform (both desktop and mobile) and high security make it one of the most interesting options out there.

DEGIRO Guide Contents:

- What is it? →

- Products →

- Security & Regulation →

- Charges & Commissions →

- Create an Account →

- Deposit & Withdrawal →

- Buying Shares/ETFs →

- Selling Shares/ETFs →

- Customer Service →

- Frequently Asked Questions →

- Alternative Investment Platforms →

What is DEGIRO?

DEGIRO is a low-cost brokerage platform with its headquarters in Amsterdam.

| 📅 Founded: | 2008 |

| 🏷️ Real Assets: | ✅ |

| 🔖 CFDs: | ❌ |

| 🇬🇷 Greek Stocks: | ✅ |

| ½ Fractional Stocks: | ❌ |

| 💳 Deposit Methods: | Wire Transfer |

| 💳 Min. Deposit: | €1 |

| 💰 Commissions: | Low |

| 💰 Withdrawal Fees: | Free |

| 💰 Inactivity Fees: | Free |

| 💰 Foreign Exchange Conversion Fee: | 0.25% |

| ⚙️ Regulated: | BaFin, DNB, AFM |

| 🎮 Demo Account: | ❌ |

| 🎁 Sign-up Bonus: | €100 Bonus |

Founded in 2008 by 5 employees of Binck Bank (a brokerage company), with the initial purpose of serving the professional investment market.

From 2013 onwards, its orientation changed towards the retail market, offering thousands of European individuals access to stock exchange products of dozens of countries.

In 2020 DEGIRO joined forces with Flatex Bank and merged with flatexDEGIRO Bank AG in early 2021, creating the largest brokerage platform in Europe with its own banking license.

It currently serves more than 2,500,000 European clients and manages assets under management (AUM) of around €51.7 billion (source).

Investment products at DEGIRO

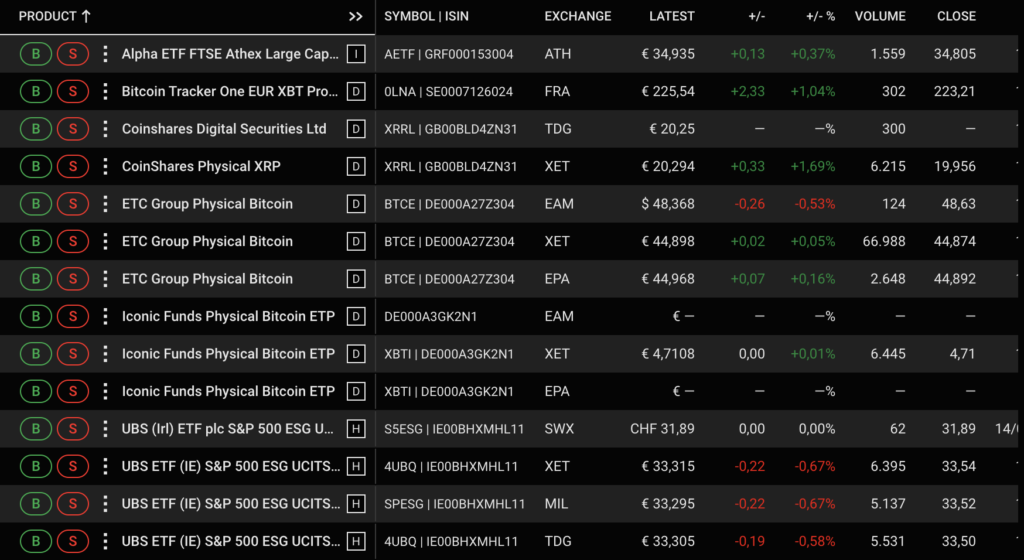

DEGIRO provides access to a wide range of financial products from global markets. You can invest in more than 29 exchanges – either through direct access or through a third party (Morgan Stanley) with Smart Order Routing (SOR).

In addition to the usual suspects, such as the American and UK stock exchanges, you get access to many more exchanges in Europe, North America, Asia and Oceania.

| 🏛 Stock Exchanges: | 29 | |

| 🇬🇷 Greek Stocks: | Yes (140 companies) | |

| 📈 Global ETFs: | 7.000+ (via degiro.ie) | |

| 🏷️ Bonds: | 649 | |

| 🇬🇷 Greek Government Bonds: | Yes (24 bonds) | |

| 🇺🇸 NASDAQ | 🇺🇸 New York (NYSE) | 🇬🇷 Athens (ATHEX) |

| 🇨🇦 Canada (TSX) | 🇬🇧 London (LSE) | 🇩🇪 Frankfurt (XETRA) |

| 🇨🇳 Shanghai (SSEC) | 🇨🇳 Shenzhen (SZSC) | 🇯🇵 Tokyo (JPX) |

| 🇮🇪 Dublin (Euronext) | 🇳🇱 Amsterdam (Euronext) | 🇫🇷 Paris (Euronext) |

| 🇵🇹 Lisbon (Euronext) | 🇮🇹 Milan (Borsa Italiana) | 🇨🇭 Switzerland (SIX) |

| 🇭🇰 Hong Kong (XKEX) | 🇦🇺 Australia (ASX) | 🇪🇸 Madrid (Bolsa de Madrid) |

Through DEGIRO you can invest in financial products such as:

#1 Stocks

Stocks are considered one of the most well-known investment vehicles in the world. Holding a stock makes you a partial owner of the company with a right to its profits.

Investors make money from stocks in 2 ways:

- Price appreciation: the price of a stock goes up

- Dividends: regular payments to shareholders deriving from the company’s profits

Can I invest in Greek shares? Yes, DEGIRO provides access to the Greek stock exchange along with the 140 companies that are being publicly traded on it.

Typical examples: PPC (DEI), OPAP (OPAP), National Bank (ETE), Eurobank (EUROV), Alpha Bank (ALFA), Aegean (ARAIG), Optima Bank (OPTIMA), Jumbo (BELA), Motor Oil and Mytilineos (MYTIL).

Can I invest in foreign stocks? Of course! DEGIRO gives you access to 29 stock exchanges, including those of New York (NYSE), NASDAQ, London (LSE), Frankfurt (XETRA) and so on.

✍ Read also: What is a stock, how do they work and how can you make a profit by investing in one →

#2 ETFs – Exchange Traded Fund

ETFs (Exchange Traded Funds) are a collection of securities (such as stocks and bonds) that track the performance of a stock market index.

One of the most known examples is the SPDR S&P 500 ETF (SPY), which tries to imitate the performance of the S&P 500 Index – which contains 500 American companies with the largest market cap

✍ Read also: What is an ETF, how does it work and why it is worth investing in one →

❗ The problem of PRIIPS, KIDs and the ban on ETFs in Greece.

DEGIRO gives you access to more than 7,000 ETFs, such as the popular VUAA, VUSA and VWCE, but… not if you have an account on the Greek platform (degiro.gr)!

Why? Our beloved European bureaucrats, in their effort to protect us, have screwed up! With the recent change in European PRIIPs legislation, brokerage platforms are not allowed to sell ETFs that do not have the KID document translated into the local language to retail investors.

What is a KID (Key Investor Document)? It is a document that contains the key information of an ETF and is available to investors. Through it they can get insight into where the ETF invests, the level of risk it takes, past performance, etc.

As you can see, very few companies bothered to translate the document for a small market like Greece. Hence, you can only find (!!!!) 14 ETFs in DEGIRO currently.

Lucky us, we can bypass the legislation if we use the Irish branch of DEGIRO, called degiro.ie.

How can we do it?

- Log in to degiro.ie

- Create an account using exactly the same details as the Greek account (email, VAT, name, address, etc.)

- Voila! You are now granted access to every single ETF

If you already have ETFs purchased on degiro.gr, you can transfer them internally by sending an email to [email protected] cost is €7/seat. See more here →

So, to sum up:

🇮🇪 If you are interested in buying and selling ETFs, an Irish account (degiro.ie) is a one-way street →

🇬🇷 If you are not interested in ETFs, then there is no restriction, and you can open an account in the Greek branch (degiro.gr) →

💡 What do I recommend? Set up an Irish account to finish so you have all the options available. It’s no different from the Greek one, apart from the language.

🚩 Either way, in both cases, you are entitled to the €100 bonus in debit credit

✍ Read also: how you can overcome the problem of buying ETFs from Greece due to PRIIPs →

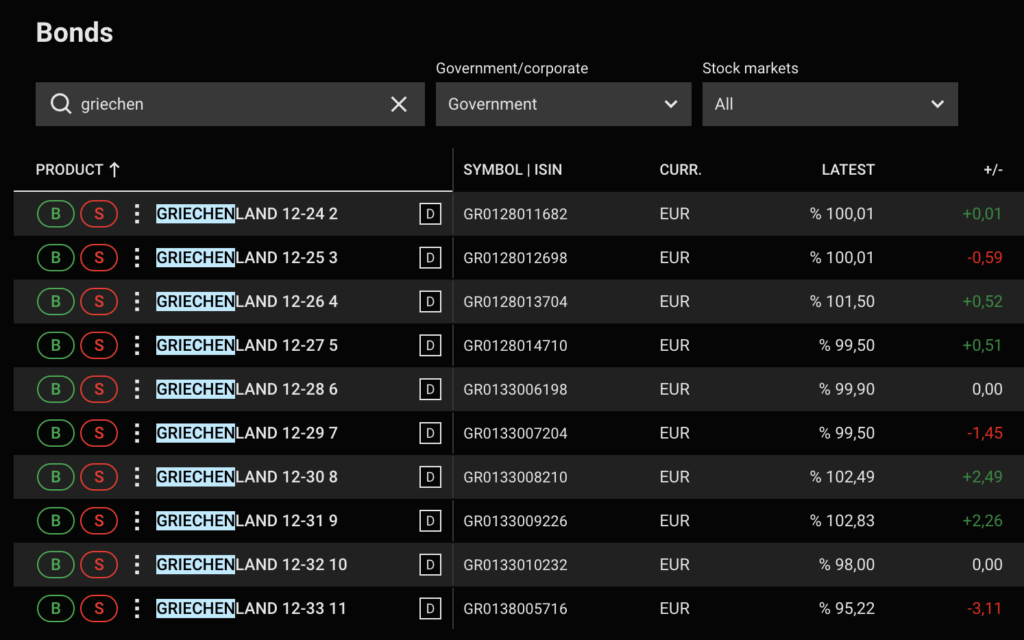

#3 Bonds

A bond is a debt document. The issuer is obliged to pay interest to the buyer at specified intervals and to repay the face value at the end of the contract.

In short, you can think of bonds as a form of loan that comes from the capital markets and not from a bank. Bonds can be issued by countries or companies.

Can I invest in bonds with DEGIRO? Yes, DEGIRO gives you access to more than 600 government and corporate bonds.

Can I buy Greek government bonds? Yes, you can ” lend” to the Greek government through 24 different Greek government bonds. To find them on DEGIRO you need to search for them with the term “GRIECHENLAND”.

✍ Read also: what they are, how they work and why you might want to invest in Bonds →

#4 Mutual Funds

Mutual Funds are common investment portfolios involving investors sharing the same investment philosophy and common objectives. Instead of investing their money independently, they pool their money to create a large and powerful fund divided into shares of equal value.

Mutual funds are managed by MFMC (Management Companies) and do not pay interest or predetermined returns. Their performance is measured by the difference between the capital invested and its valuation over a certain period.

#5 Futures, Options, Warrants & Leveraged Products

Finally, you can invest in Options (ή στα ελληνικά, Δικαιώματα Αγοράς), Futures (ή στα ελληνικά, Συμβόλαια Μελλοντικής Εκπλήρωσης), Warrants and Leveraged Products, but I will not discuss them further here as they are more advanced investment products.

✍ Read also: what are Options and how they work, in the detailed guide I have written →

#6 Forex & Crypto

On the flip side, through DEGIRO you cannot participate in the global currency market (commonly called forex trading), and it does not have access to cryptocurrencies.

If you want to get involved with cryptocurrencies, take a look at the best exchanges, while if you are interested in forex trading, take a look at AvaTrade →

Is DEGIRO safe?

Yes, DEGIRO is a highly secure platform overseen at many levels by prestigious regulatory authorities.

| Operating: | 15+ years |

| Banking License: | Yes |

| Deposit Guarantee: | up to €100.000 |

| Provided: | German Deposit Guarantee Scheme (Edb) |

| Main Supervision: | German Capital Market Commission (BaFin) 🇩🇪 |

| Additional regulation: | FCA 🇬🇧, AFM 🇳🇱 |

| Investment Guarantee: | up to €20.000 (90%) |

| Asset segregation: | Yes |

| Listed on a Stock Exchange: | as flatexDEGIRO AG |

| Balance sheet disclosure: | Yes (as flatexDEGIRO AG) |

| Affiliation of the Greek section: | in Germany 🇩🇪 |

DEGIRO’s operation is regulated and supervised: it is supervised by the Dutch National Bank (DNB) and regulated by the German Federal Financial Markets Authority – Bundesanstalt für Finanzdienstleistungsaufsich (BaFin).

| Regulator: | Licence: |

|---|---|

| Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) | |

| De Nederlandsche Bank (DNB) | License: R182877 |

| Dutch Authority for the Financial Markets (AFM) | License: 14002441 |

🛡️ Deposit protection up to €100,000. As part of Flatex bank (from ’20), DEGIRO has a banking licence, so its customers’ cash deposits are protected by the German deposit guarantee scheme (Edb) for amounts up to €100,000.

🛡️ Investment protection up to €20,000: DEGIRO operates as a licensed investment company, so its clients’ investments are protected by the EU Investment Compensation Scheme (ICS) for amounts up to €20,000 (up to 90%). The responsible regulator is the German Capital Market Commission (BaFin)

Operating since 2008: the more years a company has been in operation, the more financial events and crises it has successfully weathered.

Asset Segregation: DEGIRO keeps its clients’ assets in different accounts from its own. In the event of bankruptcy (and therefore liquidation), clients have the option of transferring them to another institution, and the company has no right to use them. It is forced to do so and is monitored for this.

🧾 It publishes financial data: As a member of flatexDEGIRO AG (FTK.DE) trading on the stock exchange, it is forced to publish its financial results publicly.

🛡️ Security: In general, the company’s security is at an extremely high level. I would rank it slightly below Interactive Brokers and Saxo Bank but higher than eToro, Trading212 and Freedom24.

DEGIRO fees and commissions

Low commissions are the strongest part of the company, according to what they tell us. Is this true, or are we being sold a bunch of baloney?

Before we get into the analysis, let’s divide commissions into two main categories:

- Fixed fees (non-trading fees): specific fees on a more fixed basis that have nothing to do with market trading

- Trading fees: commissions retained as a percentage or fixed amount on purchases and sales of exchange-traded products

#1 Fixed fees

I have good news for you as DEGIRO charges almost no non-trading fees to its clients. There are no fees for creating a new account, depositing or withdrawing funds, custody and inactivity fees.

| Account Creation: | Free |

| Deposit: | Free |

| Withdrawal: | Free |

| Inactivity fee: | No |

| Custodian: | Free |

| Connectivity fee: | €2,5 /year/stock exchange |

| Exchange fee: | 0.25% |

| Min. Deposit: | €1 |

The only fixed charges are the connectivity and currency conversion fees.

🔗 What is the connectivity fee? Every calendar year, DEGIRO will charge you €2.5 to connect to any exchange outside your country.

Example of charging: let’s say you have bought shares from 3 stock exchanges: the Frankfurt, Amsterdam and Athens stock exchanges, and your account is from Greece. The connectivity charge for the above example will be 5€/year for connecting to the Frankfurt and Amsterdam stock exchanges.

(FRA: 2.5€, AMS: 2.5€, ATH:0€)

💱 What is the currency conversion fee? If you want to buy an investment product in a currency other than the one you hold your funds in DEGIRO will charge you a 0.25% fee for currency conversion.

#2 Transaction Fees

DEGIRO’s transaction fees are among the lowest in the market!

| Προμήθεια | Κόστος χειρισμού | Σύνολο | |

| 🇺🇸 US Stocks: | €1 | €1 | €2 /order |

| 🇬🇷 Greek stocks: | €0,5 | €1 | €1,5 /order |

| 🇬🇧 UK stocks: | €3,9 | €1 | €4,9 /order |

| 🇩🇪 German Stocks: | €3,9 | €1 | €4,9 /order |

| 🇫🇷 French Stocks: | €3,9 | €1 | €4,9 /order |

| 🇯🇵 Japanese Stocks: | €5 | €1 | €6 /order |

| 📈 Global ETFs: | €2 | €1 | €3 /order |

| 🔮 Futures: | €0,75 /contract | 0 | €0,75 /contract |

| 📝 Options: | €0,75 /contract | 0 | €0,75 /contract |

Specifically, you can buy and sell U.S. stocks for €2 / order, Greek stocks from €1.5 / order and ETFs from €3 / order.

Examples of commissions at DEGIRO

To better understand the commissions DEGIRO charges with each trade, we will look at some examples.

Let’s say you want to invest a capital of €1,000. Let’s see what DEGIRO’s commissions are for:

- Buying U.S. stocks

- Buying Greek stocks

- Buying German stocks

- Buying ETFs

🇺🇸 Commission for buying U.S. stocks

Assuming you buy 1,000€ worth of U.S. stocks. DEGIRO will charge you a total commission of €2.00. Analysis: €1 fee + €1 management fee so €2/transaction

⚠️ Warning:

US Stocks are traded in Dollars ($). If you maintain your account in Euros (as a user from Greece) then DEGIRO will undertake to convert your Euros into Dollars before proceeding with the transaction.

The currency conversion fee is set at 0.25%.

🇬🇷 Commission for buying Greek stocks

If you invest €1,000 in a Greek stock, DEGIRO will charge you a total commission of €1.50. Analysis: €0.5 fee + €1 management so €1.5/transaction

🇩🇪 Commission for buying German stocks

If you invest €1,000 in a German stock, DEGIRO will charge you a total commission of €4.90. Analysis: €3.9 fee + €1 management fee so €4.9 /transaction

🌎 Commission for buying free ETFs

If you invest €1,000 in one of the selected free ETFs, DEGIRO will charge you a total commission of €1. Analysis: €0 fee + €1 management so €1 /trade

Let’s look at an example where you want to buy parts of the iShares ETF tracking the S&P500 index (iShares Core S&P 500) from the Euronext Stock Exchange, Amsterdam:

🌎 Commission to buy other ETFs

If you invest €1,000 in any ETF, DEGIRO will charge you a total commission of €3.

Analysis: €2.0 + €1 /trade

Let’s look at an example where you want to buy parts of the Vanguard ETF tracking the S&P500 index (Vanguard S&P 500 – VUSA) from the Borsa Italiana Stock Exchange, Milan:

Below, you will find a table showing the total commissions you will be asked to pay DEGIRO for investments of €1,000.

It is important to note that the commissions remain fixed regardless of the amount invested.

So you would pay the same if you invested €100, €10,000 or €100,000.

| Product | Investment | Total Charge |

| 🇺🇸 US Stocks | €1.000 | €2 |

| 🇬🇷 GR Stocks | €1.000 | €1.5 |

| 🇩🇪 DE Stocks | €1.000 | €4.9 |

| 🌎 Selected ETFs | €1.000 | €1 |

| 🌎 Rest of ETFs | €1.000 | €3 |

If you made the same purchases through the traditional route like a Greek bank, the commissions would be incomparably higher.

How do I open an account with DEGIRO?

Although it is the most boring stage, setting up a new investment account with DEGIRO is relatively quick, relatively easy, and completed 100% online.

What you will need:

- Identity document: Passport or ID card (new type).

- Document of residential address: Any official document showing your home address. This can be a utility bill, a bank account or a card statement (from e-banking) in English.

- Internet connection

- Mobile phone

💡 Tip: If you have a passport, use it. If you have a passport, use something in English, like a bank statement from a digital bank (Revolut, N26, Wise, etc.) as a residential address document.

🎁 Is there a Sign-up Bonus? If you use this link, you will earn €100 discount on fees for your first transactions →

If you find it difficult? You can contact them by phone at +30 211 176 8291 or by email at [email protected].

🤝 I can help: If you run into a problem, send me an email and I’ll help you for free if I can – if you also did the affiliate link sign-up (degiro.gr or degiro.ie), I’d appreciate it even more.

Let’s go over the basic registration steps:

Step 1: Basic Information & Email Verification

Open the DEGIRO page in 2nd tab and follow the guide below, so you don’t run into any problems!

After filling in your details, you will receive an email in which you will need to verify your details.

Step 2: Personal details

Once you have verified your email, the process of creating your account begins. You will need to fill in some personal details, such as your Full Name – in English, as it appears on your ID card or passport.

You will then need to confirm your mobile phone number.

Next, the address of your current residence.

Next, the details of your date and place of birth

…if you are a US Citizen… (You’re not, are you?)

Step 3: Link a bank account

It’s time to link your bank account.

⚠️ Warning:

This account must be in the name you created the account in (i.e. your name) and will be the account from which you can deposit and withdraw your funds.

⚠️ Personal Experience:

In the past, I had sent a wire transfer to my DEGIRO account from a different Greek IBAN than the one I had registered, but it was under my name. The money was added like usual, but with a delay because the company had to contact me to confirm that it was indeed me.

Step 4: Confirmation of identity

It’s time to confirm the information you provided earlier.

You can do this by uploading your passport or ID card.

Finally, you will be presented with a form with all your details. If everything is correct, click “Submit”!

Depositing and Withdrawing money

After you have created your account and it is approved the next step is sending money. This will be the first fund you will use for your investments!

The only way to send money to your DEGIRO account is by wire transferring money from the bank account you registered when you signed up.

#1 Deposit money to DEGIRO

👍 On the good news: There is no fee for receiving money from DEGIRO and no minimum deposit limit; the money appears in your account by the same business day.

👎 On the bad news: The bank from which you send money via wire transfer will, in all likelihood, charge you. Also, debit cards or e-wallets are not supported.

| Deposit Fees: | Free |

| Min. Deposit: | €1 |

| Methods: | Wire transfer |

| Time: | 1-3 business days |

Login to DEGIRO and select “Deposit/Withdrawal” from the menu.

There, you will find the details of the DEGIRO account (iBan, Bank Name, Beneficiary Name, BIC, etc.) to which you will make the wire transfer.

The next step is to log in to the e-banking of the bank you work with and send a wire transfer to the above details.

Once you send the wire transfer, the money will arrive in your brokerage account in 1 to 3 business days, ready to be invested!

⚠️ Warning:

DEGIRO does not work with digital banks such as Revolut and N26, so you cannot send money to your account.

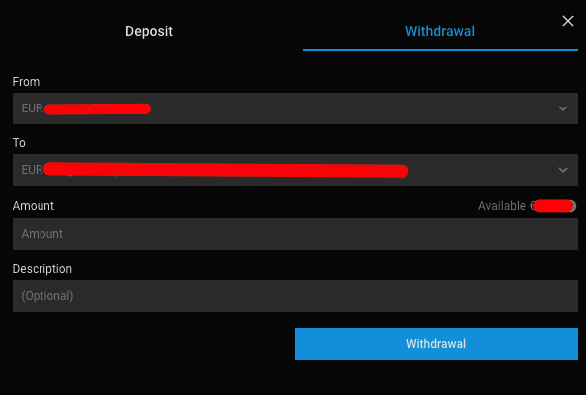

#2 Withdrawing money from DEGIRO

The process of withdrawing money from DEGIRO is even simpler.

You select the same button again from the menu.

Next, you select the account to which the money will be sent (the same account from which the deposit was made), the amount and then “Transfer”.

Withdrawals are completely free of charge and take 3-5 business days to reach your account.

⚠️ Personal Experience:

I have tried the withdrawal. It went smoothly, and the money arrived to me within 2 business days without charge.

How I buy stocks and ETFs

Having created an investment account and having already made the first deposit into it, you are all set to go ahead and purchase your first investment product.

In this example, I will show how you can do this by buying ETFs of the S&P500 index from Vanguard with a hypothetical capital of $200.

⚠️ Warning:

Just because I choose to invest by buying this particular Asset does not mean you should do so.

The steps below will show you how to buy any other investment product offered at DEGIRO (such as company stocks or different ETFs).

The following instructions are not a suggestion to buy or investment advice.

#1 Searching ETFs and stocks

To be able to find the Investment Product you want to buy on DEGIRO, you will need to use their Search Bar. You’ll find this in the top left of the menu:

It allows you to locate the Asset you are looking for by typing its name or ISIN Number.

As we mentioned, we want to invest in the S&P500 ETF managed by Vanguard, which has a Ticker Sign of VUSA.

We type S&P500 into the Search Bar and see that the following options appear:

As you notice, we find the same ETF (all have the same name and ISIN Number) trading on different Exchanges and different currencies.

Specifically:

- On the Milan Stock Exchange (MIL) in Euro

- On the London Stock Exchange (LSE) in GBP

- On the Amsterdam Stock Exchange (EAM) in Euro

- On the Zurich Stock Exchange (SWX) in Swiss Francs

Essentially, since it’s the same ETF (you can tell this by the fact that the ISIN Number is the same everywhere) we will choose an Exchange that trades in our currency, i.e. the Euro. This will be either Milan or Amsterdam.

⚠️ Tip:

To reduce the annual Connectivity Fee, it is advisable to choose (if possible) to buy your investment products from a specific Exchange.

Let’s say we choose the Milan Stock Exchange, to proceed with purchasing the ETF we need to click on the tiny green buy button that says “A”.

#2 Buying ETFs and stocks

Once you click on the buy button, the DEGIRO Buy/Sell order entry tab will open on the right side of your screen.

Before we proceed with buying the ETF, let’s clarify what the available buy orders mean:

Limit Order, No Limit Order & Stop Limit:

Limit, No Price Limit and Stop Limit orders refer to the orders you can give DEGIRO about what price you would like it to proceed to buy the ETF at.

If you select No Price Limit Order, DEGIRO will proceed to purchase the ETF at the price it currently has in the market.

Specifically at $60.23 /unit.

If you choose Limit Order, then you tell DEGIRO to buy the ETF once the price reaches a certain point that you set.

For example, you can set a buy price at $60/unit. As soon as (and if) the ETF price drops to $60, DEGIRO will automatically execute the buy order.

For this example, I will buy the ETF with an order with no price limit, as I want to buy it immediately without waiting for it to reach a different price.

Daily Order/ Good ’til canceled (GTC):

If you choose Daily Order, the order will remain open until the end of the day (or the close of the Exchange). If it fails to execute, it will be automatically deleted.

If you select Good ’til cancelled (GTC), the order will remain open until it is executed or deleted by you.

Since I choose an order without a price limit, it does not matter which one I choose as the order will be executed immediately (as long as the Exchange is open).

Units:

Here, you are asked to select the quantity of ETF units you would like to own.

For this example, if I want to invest an amount of €200, I will choose to buy 3 units, leaving me with a balance of €19.31.

3 * €60,23 = €180,69

Keep in mind, that at DEGIRO you cannot buy fractional stocks or ETFs.

Once you have set the order you want to place, click “Place Order”.

A window will pop up with all the information about the order you are about to give in which DEGIRO’s fees will be displayed. If everything is OK, click “Confirm” to execute the order.

Congratulations, you own 3 units of the S&P500 ETF! Your money is now invested in the 500 most powerful companies in the U.S.

To view all your open positions in DEGIRO, select “Portfolio” from the menu on the left.

How to sell stock and ETFs

Want to liquidate your investments to receive the profits (or losses) in cash?

Let’s see how to do this with an example, selling 10 stocks of Aegean we own.

Start by clicking “Portfolio” from the main menu on the left and identify the open positions you want to liquidate (sell).

Pressing “P” opens the order entry tab we encountered during the ETF buying process.

If we want to sell the share at the current market price (€4.96), we must select Order without Price Limit.

If, on the other hand, we want to set more complex conditions to automatically sell the share (e.g. at a specific price) then we should choose one of the Limit, Stop Loss & Stop-Limit orders.

DEGIRO Customer Service

My experience with DEGIRO customer service, although not extensive, is quite good. The most important thing is that there is a department that is made up of Greeks and can help you in Greek.

You can contact them

- via Email: [email protected]

- via Phone: +30 211 176 8291

- (Monday – Friday | 09.00 to 23.00)

If anyone from DEGIRO is reading us, I think adding a live chat for Customer Service would be an excellent addition that would upgrade the whole service.

⚠️ Note:

There is an option to place a purchase order by phone or email ([email protected]) it just comes with an extra charge. Good old times, right?

Frequently asked questions about DEGIRO

Here are some of the most frequently asked questions on the internet about the operation of DEGIRO:

Can I try DEGIRO with a demo account?

No, unfortunately, you cannot open a demo account with DEGIRO and experiment with play money.

Are stocks and ETFs, really mine?

Yes, every stock and ETF you buy through the platform goes under your name in a joint omnibus account, managed by DEGIRO. Also, customers’ assets are kept separate from the company’s assets. This is called asset segregation, and the German Capital Market Commission guarantees that DEGIRO carries it out. Apart from that, at any time you can transfer your investments to other broker companies.

Is there a bonus for registering with DEGIRO?

Yes, there is! If you create a new account by following this link, you will earn a €100 credit for your first commissions on the platform.

Is DEGIRO a scam?

No, DEGIRO could not be a scam. It has been operating since 2008 and was acquired by Flatex Bank in 2020, creating the largest online investment order execution platform in Europe. It is supervised by prestigious regulators such as BaFin in Germany and the AFM in the Netherlands and has a banking license.

Can I buy Greek shares?

Yes, DEGIRO offers access to the Greek stock exchange. You can buy and sell more than 140 Greek stocks, including Aegean (AEGN), Jumbo (BELA) and Mytilineos (MYTIL). Each order costs around €1.5 – one of the lowest commissions in the market.

Can I buy foreign stocks?

Of course, DEGIRO gives you access to 29 stock exchanges around the world coming from Europe, America and Asia. You will find some of the most popular ones, such as New York (NYSE), London (LSE), Hong Kong and Singapore.

Can I buy VUAA, VUSA and VWCE ETFs at DEGIRO?

Following the implementation of the PRIIPs legislation, most ETFs have been prohibited from being sold to Greek investors because they do not have translated KIDs documents in the local language. You can bypass the ban by creating a similar account on the Irish degiro.ie where you will find more than 7,000 ETFs available.

Does the ban on buying ETFs due to PRIIPs apply to DEGIRO?

Yes, Greek investors cannot buy ETFs that do not have the KID document translated into the local language. For this reason, at the moment at DEGIRO you will only find 24 ETFs if you have a Greek account. You can bypass the ban by creating an account of your own on the Irish platform of degiro.ie where you will find more than 7,000 ETFs available.

Can I transfer my ETFs from degiro.gr to degiro.ie?

Of course, by following two steps: You need to create an account on degiro.ie with the same details (name, VAT, address, email) and then contact customer service ([email protected]) requesting an internal transfer. The cost is €7 per position.

Can I buy Greek government bonds?

Yes, at DEGIRO you will find approximately 24 Greek government bonds on the secondary market. Look for them under the category “bonds” named “Griechenland”.

Is there any problem with DEGIRO?

After using the platform as a client for long enough, I can identify three problems:

- the issue with the ETFs (which can be solved with an Irish account)

- the absence of interest on your cash deposits

- the compulsory securities lending for which you get no compensation

Is DEGIRO available in Greece?

Yes! Any Greek citizen can open a personal investment account with DEGIRO.

Can I use DEGIRO in the Greek language?

Yes, DEGIRO is available in Greek. You can change the language of the application by following these steps: Menu > Personal Settings > Language > Ελληνικά.

Are there any alternative platforms?

Of course, there are! With the current data, I believe Saxo Bank offers one of the most advantageous packages for long-term investors – both from a security and a commission point of view

If you want to judge for yourself, take a look at a comparison between the most popular brokerage platforms in Greece →

Don’t forget that investing involves risk. You may lose part or all of your fortune.

Risk Disclaimer:

I am NOT a professional investment advisor and the following is NOT an investment recommendation but is my personal experience and opinions.

Keep in mind that always investing = risk.

Only invest money that you are willing to lose!

Affiliate Disclaimer:

The above links to the services listed may be affiliate links. If you use the service through them then you are helping MoneyMinority to continue to exist, at no extra cost to you.

Feel free not to use them if you do not wish to.

Read more about Risk & Affiliate Disclaimers of MoneyMinority.

![Saxo Bank: In-Depth Guide – Is it a Scam? [2024] Saxo Bank Αναλυτικός Οδηγός και η Γνώμη μου (4)](https://moneyminority.com/wp-content/uploads/2024/02/Saxo-Bank-Αναλυτικός-Οδηγός-και-η-Γνώμη-μου-4-768x432.png)